Table of Content

Retirees usually make investments a larger portion of their assets in bonds so as to set up a reliable revenue complement. The inventory market is often measured in phrases of whole market capitalization, meaning the value of all shares in firms issued and tradable on public markets. Each share represents a stake in possession in a publicly traded firm. The value of privately held companies, from mom-and-pop operations to huge enterprises owned by private fairness funds, often is not included. The U.S. government bond market is the most important, most reliable and liquid on the planet. It is represented by United States Treasury bonds and by non-marketable securities.

Global equity market capitalization elevated sixteen.6% Y/Y to $124.four trillion in 2021, as world equity issuance rose to $1.0 trillion, an increase of 25.6% Y/Y. Prior to buying shares, buyers often take a look at historical inventory value charts to gauge the price momentum of a inventory and to see where they're buying the inventory relative to its historical efficiency. To simplify our Bed Bath case research, we will focus on the ’24 series bonds we really helpful May 2.

Threat

Venice banned its bankers from trading government debt but the concept of debt as a tradable instrument and thus the bond market endured. Bond interest is taxed as ordinary income, in distinction to dividend earnings, which receives favorable taxation rates. However many government and municipal bonds are exempt from one or more forms of taxation. Challenges exits with growing the curiosity from institutional buyers. Tentative institutions would favor to see the liquidity there first, ideally maybe credit rating company companies and total better stock exchange infrastructure and so on. You will obtain the same cost, called a coupon cost, each month until maturity.

Global fastened earnings markets excellent elevated three.3% Y/Y to $126.9 trillion in 2021, while international long-term mounted earnings issuance decreased 3.7% to $26.8 trillion. Starting within the late 1970s, non-investment grade public corporations had been allowed to problem company debt. Securities of this late Medieval period were priced with strategies similar to those utilized in modern-day Quantitative finance. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, based on Securities Industry and Financial Markets Association . ICMA estimates the international African SSA bond market – outlined as bonds issued by an African SSA entity issued in a non-African forex – to be approximately $199bn, consisting of 370 issues.

Over 300 Pricing Sources From The Otc Market And World Stock Exchanges

Since then, overseas investment in China’s bond market has grown steadily. IMF figures present that about 3.5 % of present bond points and about 10 % of China’s authorities bonds are in overseas palms. At the end of 2018, nationwide central banks held practically 80 % of the Chinese bonds in international hands. Over the previous two years, the bonds of China’s public entities and policy banks have been included into several main bond indices, which in turn has increased curiosity in Chinese bonds outside the realm of central banks. We evaluation this Bed Bath ’24 case study not simply to point out how we do our analysis, but to show the level of information obtainable to retail company bond buyers. It’s why we believe pre-trade transparency for retail investors investing in individual corporate bonds is robust.

We imagine we are in a position to begin altering this notion by higher equipping retail investors with instruments to evaluate the worth at which they're shopping for a security. Most retail traders purchase between 5 to 25 bonds when they execute corporate bond trades. There are over a hundred dealers who can provide liquidity for these commerce sizes and, thus, ensure a competitive market. As of August 2020, ICMA estimates that the overall size of the worldwide bond markets by way of USD equivalent notional outstanding, is approximately $128.3tn. This consists of $87.5tn SSA bonds (68%) and $40.9tn corporate bonds (32%).

Bonds typically commerce in $1,000 increments and are priced as a share of par worth (100%). For broker/dealers, however, anything smaller than a $100,000 trade is considered as an "odd lot". Economists' views of financial indicators versus actual launched data contribute to market volatility. A tight consensus is mostly mirrored in bond prices and there's little value movement available in the market after the discharge of "in-line" information.

The investor receives regular curiosity funds from the issuer till the bond matures. The bonds could have a fixed interest rate or a price that floats according to the movements of a particular financial indicator. Initial public offering quantity was $153.5 billion, up 79.7% from the earlier year.

Icma Councils & Committees

In this chart, we see only 9 out of 2,092 bonds have prices at or above one hundred fifty, an effective ceiling on company bond costs. Amounts outstanding on the worldwide bond market elevated by 2% in the twelve months to March 2012 to almost $100 trillion. Domestic bonds accounted for 70% of the whole and worldwide bonds for the rest. The United States was the most important market with 33% of the total adopted by Japan (14%). As a proportion of world GDP, the bond market elevated to over 140% in 2011 from 119% in 2008 and 80% a decade earlier.

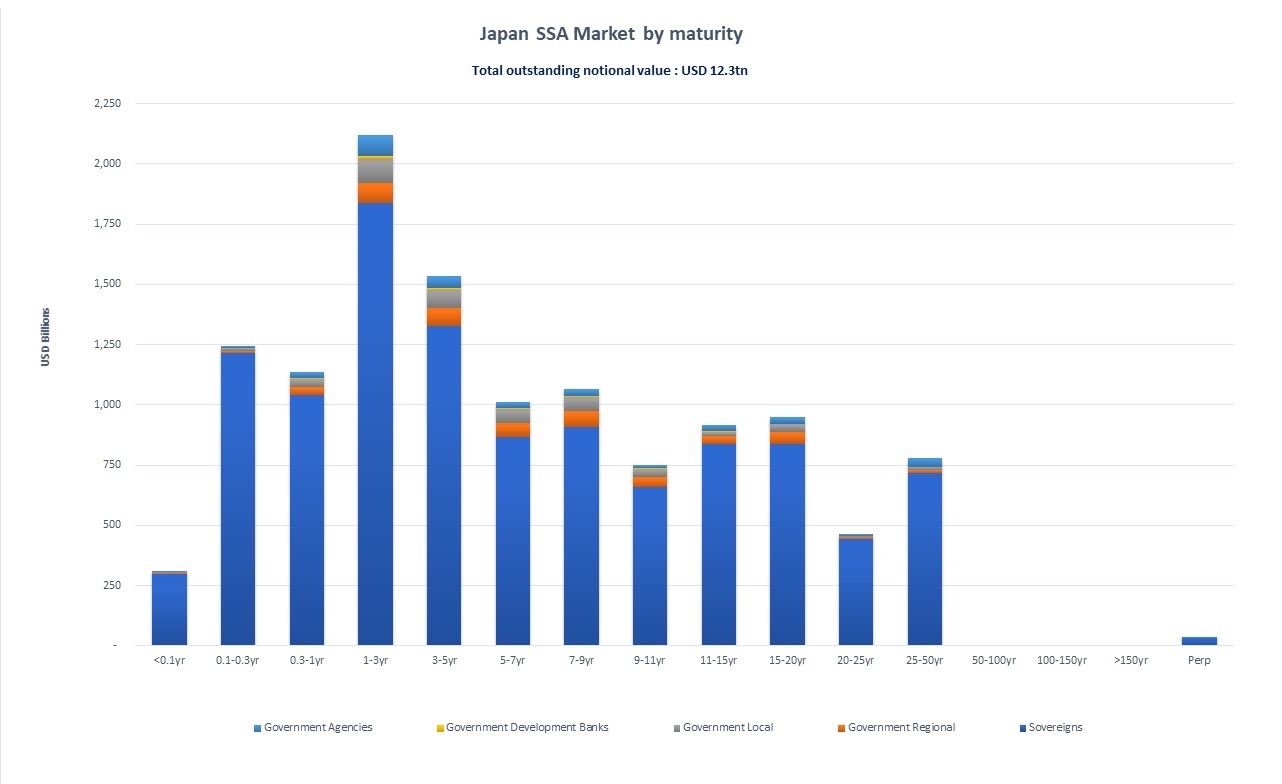

It estimates the domestic Japan corporate bond market– defined as bonds issued by companies included in Japan and issued in JPY – to be approximately $826bn. As of July 2020, ICMA estimates the notional worth of the excellent onshore China SSA market to be approximately $19.4tn, of which $7.1tn are sovereign bonds. It estimates the onshore China corporate bond market– outlined as bonds issued by firms incorporated in China and issued in CNY – to be roughly $6.95tn. The bond market consists of companies, government businesses and nonprofits that increase money by issuing bonds, basically borrowing money at curiosity from traders.

Mutual Funds That Invest In Chinese Language Rare Earth Firms

They don’t profit from you figuring out the true figures, however they do profit from you overtrading. Use as a inventory screener to find undervalued shares the world over including Asian markets, even Vietnam. All sorts of valuation metrics are displayed together with forward estimates from brokers. The Great Depression was a devastating and extended economic recession that followed the crash of the us stock market in 1929.

By issuer count, 57% of rated U.S. company issuers are speculative grade, but by debt amount, simply 28% of U.S. company debt is speculative grade . Outstanding debt devices from U.S. corporations account for 48% of world company debt. Tightening financing circumstances contributed to a 24% decline in U.S. company bond issuance in 2018. However, even with these headwinds, the extent of U.S. company debt grew by 3% through the 12 months, and this enhance was according to world credit score progress.

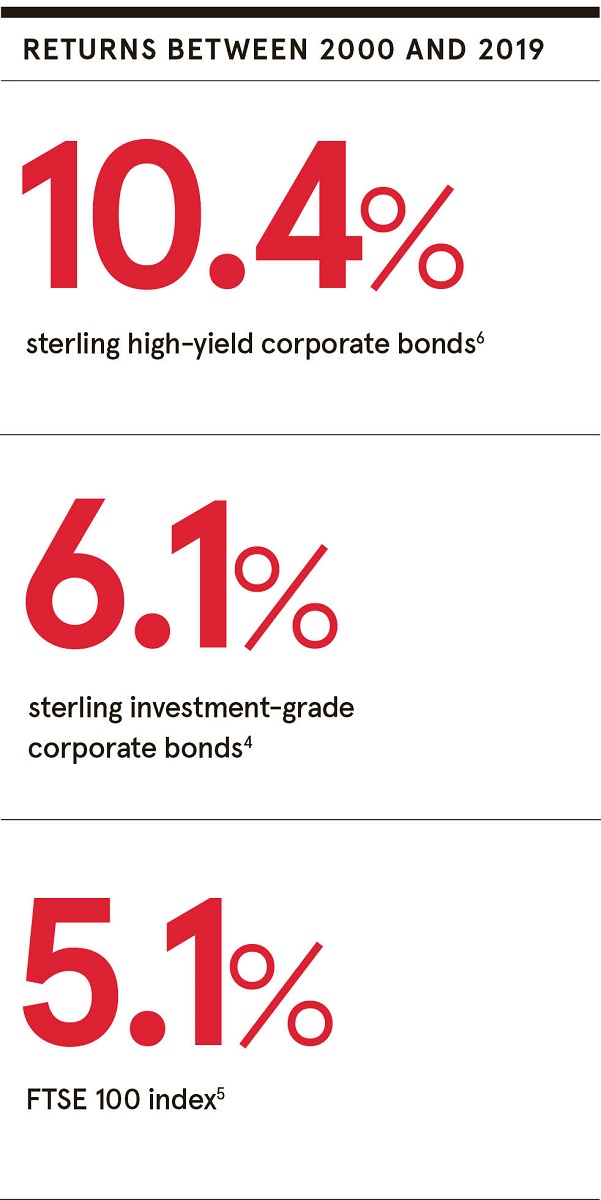

That permits the corporate to pay off your bond with funds from a model new, cheaper bond. For essentially the most half, investing in mounted earnings during the previous century was not a very profitable proposition. As a end result, right now's fixed-income investor ought to demand a higher danger premium. It wasn't until these restrictions had been lifted that the bond market began to replicate the brand new inflationary environment. For example, from a low of 1.9% in 1951, long-term U.S. bond yields then climbed to a high of 15% by 1981. The median tenor at concern of a speculative-grade loan to a nonfinancial firm is 6.5 years, whereas the median tenure of a speculative-grade bond at issue is eight.1 years.

No comments:

Post a Comment